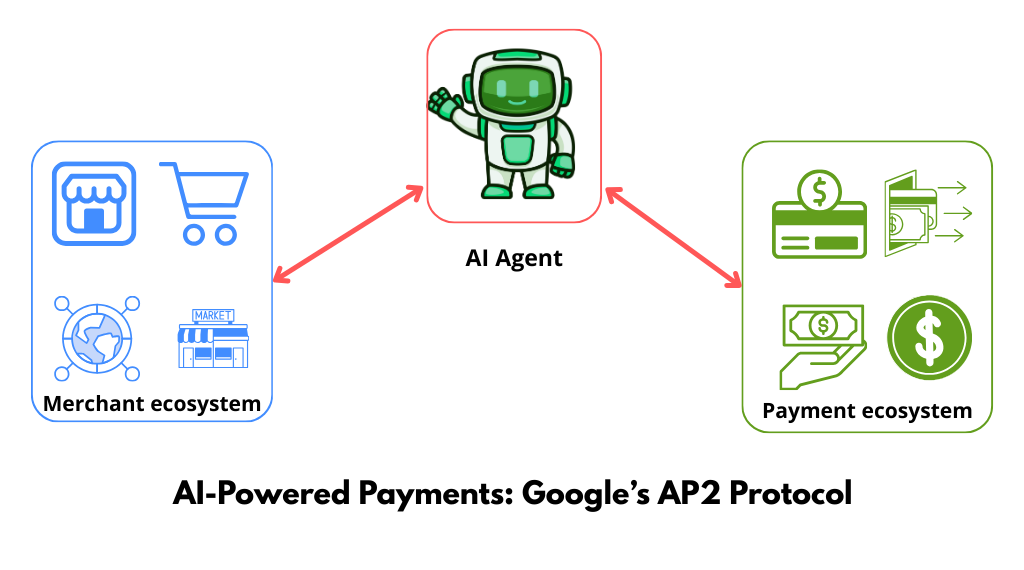

Google has just announced the launch of the Agent Payments Protocol (AP2) — a groundbreaking system designed to let AI agents and applications make autonomous, secure payments. This innovation is set to reshape the way we handle transactions, from online shopping to financial services. But what does it mean for users, businesses, and the future of digital money?

What Is Google’s Agent Payments Protocol (AP2)?

AP2 is a new payment standard developed by Google that allows AI agents to:

- Initiate transactions automatically.

- Manage digital wallets.

- Use crypto and traditional payment systems.

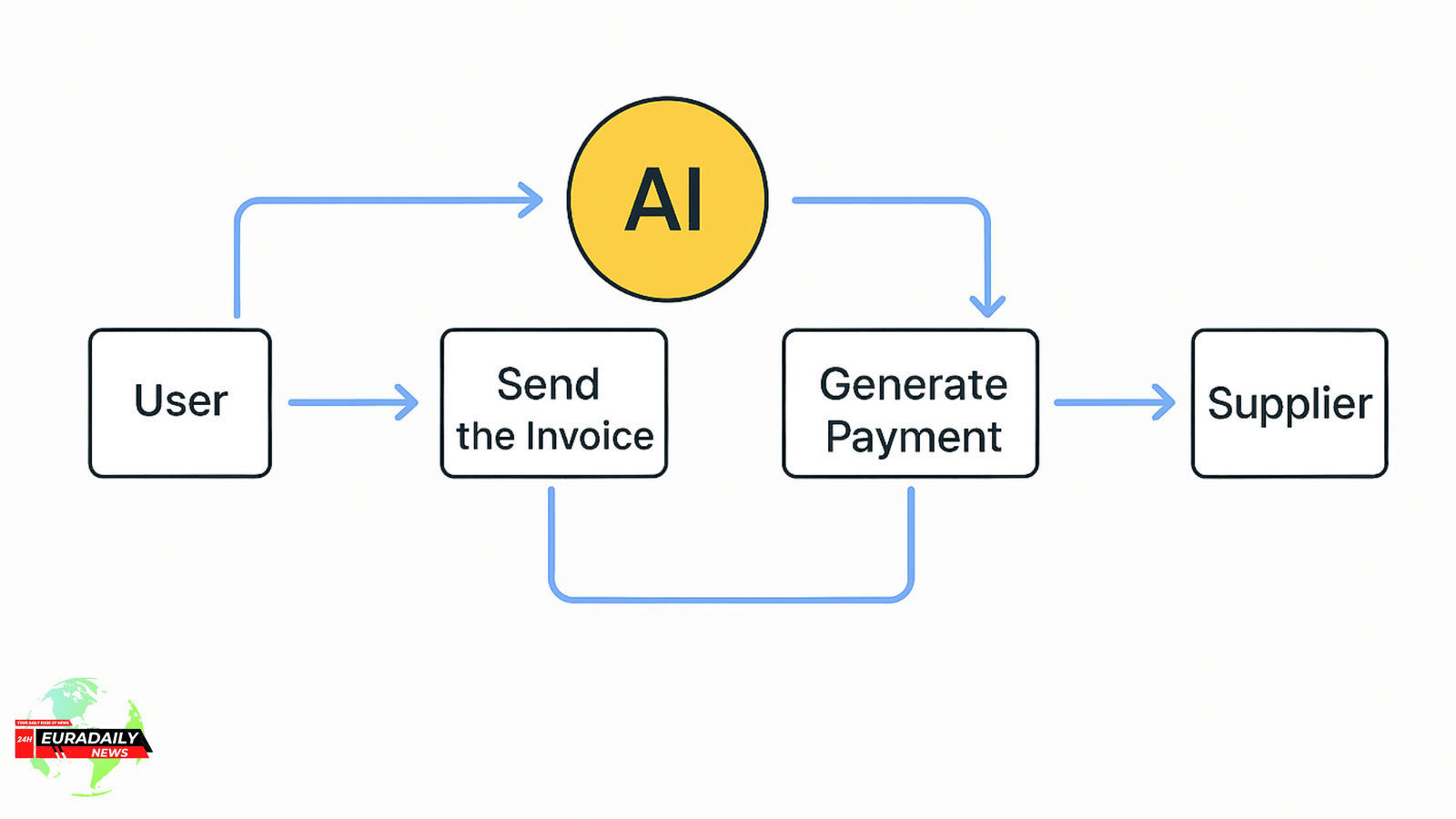

Unlike existing payment gateways, AP2 focuses on machine-to-machine transactions, meaning that your AI assistant could soon handle your subscriptions, bills, and online purchases without manual approval each time.

Why This Innovation Matters

Google’s move is more than just a payment tool. It represents a shift toward autonomous commerce, where apps and AI bots become active market participants.

Key points:

- Faster Transactions: No need for user confirmation on every micro-payment.

- Cross-platform Compatibility: Works with both fiat and digital assets.

- Security Layer: Built-in cryptographic protections to avoid fraud.

Read more about AP2 and blockchain integration: Google Agent Payments Protocol (AP2) and Blockchain – Medium

Benefits for Businesses and Users

- For Businesses: Subscription services, e-commerce platforms, and even streaming sites can automate billing.

- For Users: Less hassle managing bills, renewals, or digital purchases.

- For the Economy: Opens the door for global AI-driven marketplaces.

Potential Risks and Challenges

Of course, with every innovation comes risk. Some experts are raising questions about:

- Privacy — How much control will users lose if AI agents transact freely?

- Fraud & Security — Could hackers exploit automated systems?

- Adoption Speed — Will regulators and banks accept AP2 quickly?

Authoritative source on AP2: Google’s official announcement on AP2

Competitors and Market Reactions

Google isn’t alone in this race. Amazon, Mastercard, and fintech startups are reportedly working on similar systems. The competition will determine if AP2 becomes a global standard or just one of many payment tools.

What It Means for the Future

If successful, Google’s Agent Payments Protocol could:

- Replace traditional payment apps.

- Transform e-commerce and subscriptions.

- Accelerate the rise of AI-driven economies.

In short, AP2 could be the start of a new financial era — where humans and AI both play roles in global commerce.

Conclusion

Google’s AP2 is more than a tech update — it’s a potential revolution in how money flows online. Businesses, regulators, and users should pay close attention to this shift, as it could reshape both personal finance and the global economy.